Future Food #5: Climbing the energy price ladder

A handy chart for figuring out if you can use X to make Y

Navigating the decarbonization idea maze involves answering many questions of the form: “can you make X with Y?” Can you make synthetic fuels from renewable electricity? Can you make ammonia from electricity, or from underground rocks? (Usually, X is fossil-derived and Y is renewable electricity.)

Trying to make sense of the future of food follows a similar process. Can you make meat from plant proteins? I think so. Can you make protein-rich biomass from electricity? Likely. Can you use sugar to produce palm oil via fermentation? Unlikely. What about turning methanol into starch? Maybe. What about growing plants in the dark using acetate? Unlikely.

There’s an asymmetry when conducting a very high-level techno-economic assessment (TEA) for a novel process. You rarely know enough to prove that a process will definitively work. But you can often show that a process will likely not work. It’s always easier to find fatal flaws than work out all the nuanced criteria for success.

In this post, I want to propose a simple heuristic for assessing the viability of novel food pathways, and decarbonization pathways more broadly. I’m calling it the embodied energy price. It’s no silver bullet, but helps rule out some dead ends in the idea maze.

Food is energy

Food is a store of energy, as measured by how much energy you could get back out if you burned it. A kilogram of sugar stores about 4.3 kWh of energy, and a kilogram of palm oil stores about 10.8 kWh, for example.

The heat of combustion is the absolute minimum amount of energy that it would take to synthesize these foods from atmospheric carbon. To see this, notice that combustion in the presence of oxygen is the exact reverse reaction of photosynthesis!

Embodied energy prices

Definition: We can calculate an embodied energy price by dividing the selling price of a food by its stored energy.

A process is only viable if the input energy price is cheaper than the embodied energy price in the product. Economically favorable processes must perform an energy arbitrage, consuming a cheap form of energy and selling a more expensive form.

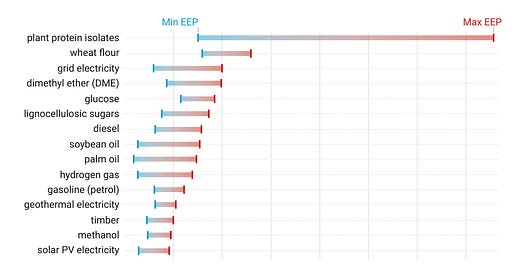

I’ve plotted embodied energy prices for some food commodities and feedstocks below. Note that this is a static snapshot, and doesn’t capture declining costs in solar or wind, for example. You can find the dataset here.

I use this chart as a guide for what you can make with what. Economically viable processes must move up the ladder of embodied energy price, converting cheap energy into a more valuable form. If you can pull this off with low emissions, your climate solution will have the tailwinds of capitalism behind it.

Ascending the ladder

What are some specific takeaways from the chart?

Turning just about any feedstock into food-grade proteins is a lucrative business opportunity. (The range for proteins extends way further to the right if you consider high-value enzymes, food additives, vitamins, etc.) Dairy proteins (e.g casein or whey), which might sell for ~$10/kg dry, would have a value of ~$1,500/kWh on this chart. High-value food proteins and enzymes are the focus of the industrial fermentation industry today, for good reason.

Savor’s thermochemical process climbs the ladder from methane to food-grade fats. Even though fats are cheap and energy-dense, it still makes sense to produce them from methane or renewable electricity at the right prices. The process has to be very efficient though!

One notable mention is Hyfe, which uses sugary waste streams as fermentation feedstock. Companies actually have to pay to dispose of these streams, so they would show up as a negative EEPs on the chart. Getting paid twice to remediate waste and then sell the result makes a lot of sense.

Taking a brief detour into synthetic fuels, Terraform Industries turns solar PV into natural gas (methane). The margin between these energy prices is extremely thin. Synthetic fuels are betting that solar gets even cheaper (~$10/MWH), and that they can sell natural gas at the higher end of the price range ($10/kcf is the target).

Descending the ladder

The chart can also help rule out processes that turn expensive energy into cheaper energy – a bad business strategy.

Using sugar (glucose) to produce food oils via fermentation is unlikely to be cost-competitive with commodity crops (e.g palm or soy). You’re taking expensive energy ($116-186/MWH) in the form of sugar, and turning it into cheaper energy ($18-148/MWH). Thinking more broadly, primary sugar is a tough starting point for anything but high value chemicals or proteins.

Cellulosic biofuel processes turn agricultural waste into petrol or diesel. This looks promising if you start from raw agricultural waste (e.g corn stover) at the bottom of the chart. The problem is that raw agriculture waste needs significant transformation before it’s in a useful form. Getting waste into a usable form (see “lignocellulosic sugars” in the chart) makes it more expensive (see GFI report), and now you’re going down the price ladder. This is why we still don’t have cellulosic biofuels.

Using grid electricity (i.e $60-$200/MWH energy) to grow food should also raise a red flag. If you start at grid prices, there’s not much room to go up on the ladder! I doubt we’ll see carbohydrates, fats, materials, or fuels produced at scale via grid mix electricity anytime soon.1

Furthermore, we saw this problem show up in the indoor farming deep dive. 1 kg of lettuce might cost $1-3 in grid electricity alone, and the cost of lighting energy far exceeds the selling price for a staple crop like soybeans.

Revisiting synthetic carbohydrates

The chart does not rule out the possibility of synthetic carbohydrate production through a chemoenzymatic process. To be specific, I’m imagining a process where you put a feedstock like methanol in, and get a dried starch powder out.

Some key insights:

You would have to start low on the ladder. I think methanol2 is the most promising feedstock, and converting it into starch (represented by wheat flour) increases the embodied energy price by about ~3x.

We then know that a viable enzymatic pathway must be ~33% efficient to break even. The ASAP cycle (methanol to starch pathway demonstrated at lab scale) has a theoretical efficiency of 61%, though the practical efficiency is probably much lower.

So far, I’m only aware of one early-stage startup with artificial carbohydrate synthesis on their roadmap. (Some companies break down lignocellulose into edible sugars, but this doesn’t count because it still requires arable land and biological photosynthesis.)

The lack of commercial interest in artificial carbohydrates is surprising to me, because the opportunity is truly a massive one. By my estimate3, at least 20% of the global calorie supply comes from flours and sugars (think bread, pasta, baked goods, drinks, candy, etc). There may well be insurmountable technical challenges, but producing carbohydrates without agriculture seems like a worthy moonshot for any ambitious synthetic biologists out there.

Conclusions

In our current food system, every carbon atom we eat originated from a photon hitting a leaf (biological photosynthesis). Even though crops are inefficient, they’re our most cost effective source of food because sunlight is free. They’ll always win the energy arbitrage game.

Nevertheless, artificial photosynthesis has enough benefits for food security, land restoration, water use, and agricultural emissions, that it’s worthwhile even when paying for the input energy.

Whether the process is chemical, biological, or enzymatic, the key is to maximize the price delta between the energy you’re consuming and selling. Grid electricity is a dead end, but utility solar and wind are now cheap enough and getting cheaper. Green methane and methanol are promising but not at price parity. If you’re interested in the future of food, keep an eye on the energy and chemical industries!

While renewables are getting cheaper, the price of grid electricity is not. For example, EIA forecasts have price projections that decline a bit until 2030, and then remain flat or increasing. The lowest price is $19/MMBTU ($65/MWH) in 2030.

It’s liquid at room temperature, can be produced thermochemically, is already in abundant supply, and is of interest to many other industries that need to decarbonize.

Corn, rice, and wheat make up an estimated 51% of the global calorie supply. Wheat is about 20%, and about half of wheat is turned into flour. So 10% of global calories come from wheat flour, and I assume rice, corn, and less common cereals increase this number to 15%. This study estimates that added sugars are 7-11% of adult energy intake in Europe, and 8-20% in the US. I conservatively add another 5% to the total share of calories from simple carbohydrates.